Are you ready for the new Sustainability Standards? WholeWorks Covers the Essentials

Business—and capital—is a powerful force, and it can be leveraged to create a more just and sustainable world, but only if it is brought to the core of enterprise. In their September 6 webinar, WholeWorks CSO Laura Asiala and CEO Matt Mayberry provide an overview of how to do just that—and the new standards that are driving it.

“Are you Ready for the New Sustainability Standards?”

That’s the question WholeWorks CSO Laura Asiala posed at the start of the WholeWorks webinar September 6.

The global demand for businesses to address Environmental, Social, and Governance (ESG) issues is growing—from investors, customers, employees—and beyond. On June 23, 2023 the International Sustainability Standards Board (ISSB) issued its inaugural standards—IFRS S1 and IFRS S2—ushering in a new era of sustainability-related disclosures in capital markets worldwide--effective January 1, 2024. (For detailed explanation on these new requirements, see Laura Asiala’s post ISSB Sets the New Standard for Sustainability: The Not-Just-The-Numbers Reporting Requirements).

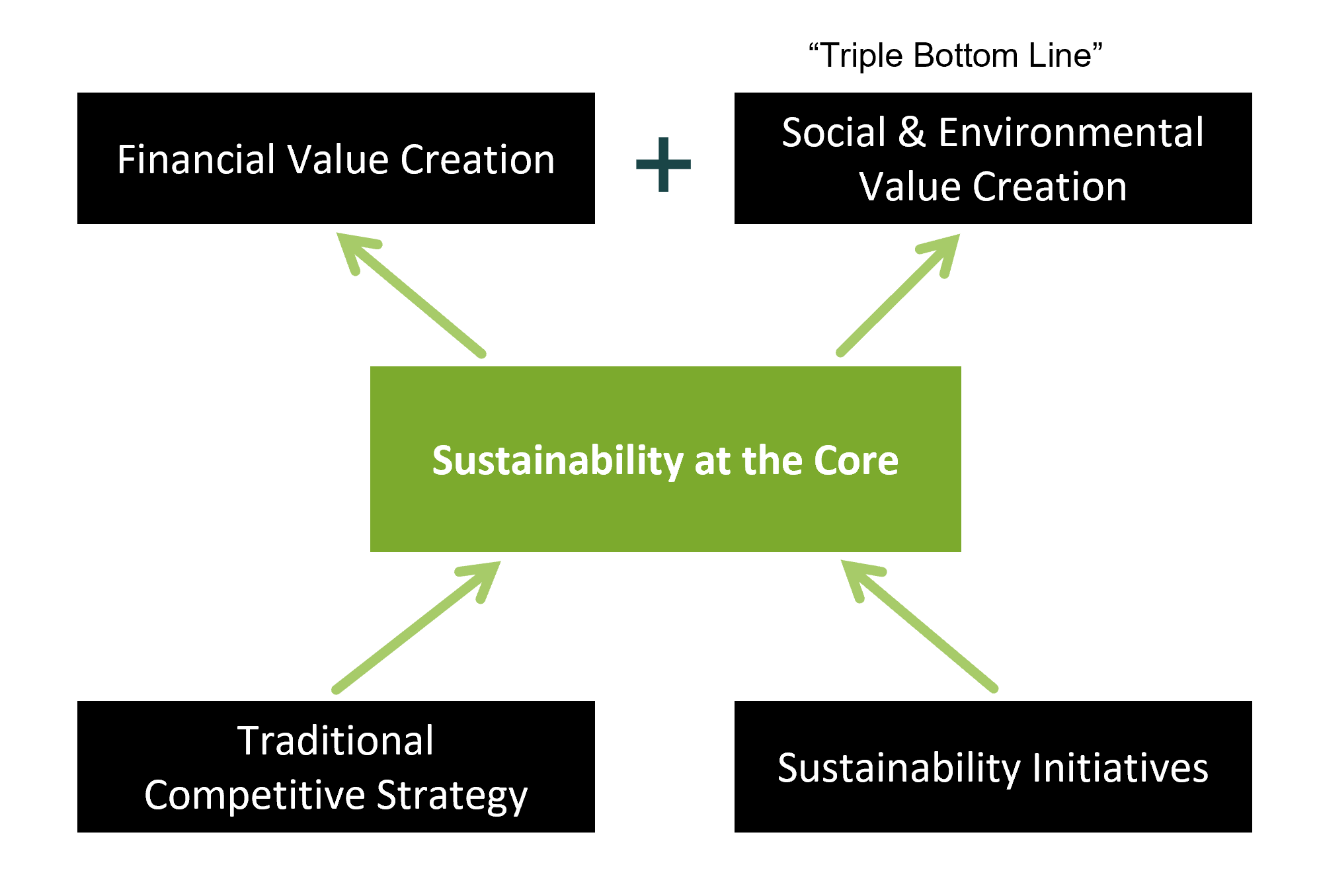

But the new requirements for reporting are just the start. Performance against the initial baseline metrics will be expected. This requires leaders and professionals of the new era to be equipped with skills and capabilities to connect the most important, or ‘material,’ sustainability (ESG) issues with a return on investment for the company and sustainable impact across the triple bottom line—and report them appropriately.

During the webinar, Laura and WholeWorks CEO Matt Mayberry covered these essentials for sustainability:

Reporting Requirements & the Corporate Action Cycle

Identifying and Prioritizing Material Sustainability (ESG) Risks and Opportunities

Developing Scenarios--from Sustainability Risk or Opportunity to Impact and ROI

Creating Sustainable Value Across the Triple Bottom Line

“Addressing the most material ESG issues and opportunities at the core of business—not on the sidelines—is the most important thing a firm can do to become truly sustainable,” said Laura. “The material nature of these issues is the key—companies need to work on the issues most important to them, the ones that impact their financial performance.”

Sustainability or ESG initiatives are too often viewed as add-ons or ‘off to the side’ from the core business. To bring sustainability to the core requires understanding how ESG initiatives can strengthen a company’s competitive strategy to create financial value. The WholeWorks Sustainable Value Creation Map© makes clear the cause-and-effect connections between ESG initiatives and value creation, creating understanding, collaboration, and commitment to action.

The Sustainable Value Creation Map (SVCM) allows leaders to ‘connect the dots’ from a material ESG initiative to a demonstrable return on invested capital to the firm and a positive impact across the triple bottom line.

Are you ready?

Are you responsible for developing the ability to respond to these new requirements?

Schedule a call here to see how WholeWorks can help you.

WholeWorks offers standard and customized consulting and learning packages for companies and organizations looking to integrate sustainability into their organizations as a way to create value and make a positive impact environmentally and socially. Our Sustainable Value Creation Map outlines how you can address both ESG risks and opportunities to create value for your organization.

Go back to the WholeWorks Connects blog page by clicking here.